A Leading, World-Class Modern Retirement Advice Service

Better Retirement Having Met Us

Many years ago, cricketing commentator Richie Benaud told a memorable story on TV.

Richie spoke of being appointed Australian Captain and the great Don Bradman approached him for the first time. Richie awaited the words of wisdom with anticipation.

Don Bradman’s only advice was, “Leave cricket a better sport having played the game”.

It was short, but succinct. It’s great advice and we adopt a similar philosophy.

We measure our success by you experiencing a better retirement having met us.

If you’d like to know what our clients think, we were surveyed independently by the Beddoes Institute. Click here to view a summary of the results.

In August 2016 David Reed was awarded as the winner of the Global Financial Planning Award (European Region). This award is a humbling addition to the October 2015 prestigious AFA Adviser of the Year.

Science of Retirement

We do one thing and one thing only. Retirement advice.

Our passion is the science of retirement.

We understand that today’s retiree wants to protect their money. They are tired of the advertisements for untold riches and fairy tales of high returns with no risk.

We understand that as you near or enter retirement, safety trumps everything else.

By giving you clear understanding of choices, and the opportunity for you to make an informed decision based upon facts, our aim is to deliver certainty.

Evidence-Based Advice

Our unwavering focus is the application of successfully proven, evidence based philosophies for retirement income.

When it comes to money, we never want to say ‘sorry’ to our clients.

We strive to prepare people for retirement better than anybody else.

Feel Confident Today

Dr. Richard Johnson in his book ‘What Color is my Retirement?’ refers to confidence as the premier emotional ingredient that contributes to the eventual success or failure of your retirement lifestyle.

Confidence must be attached with a basis in fact.

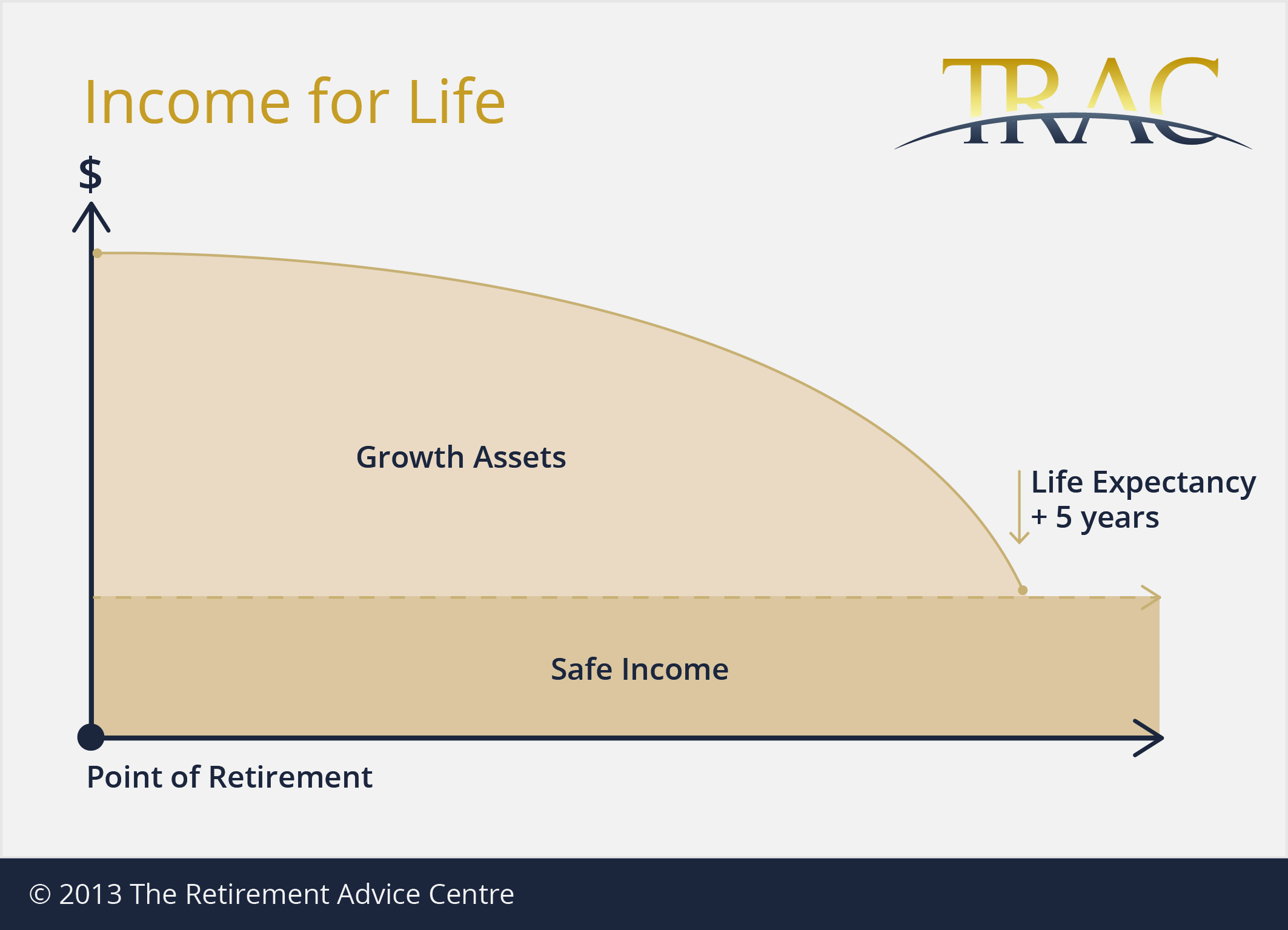

Using evidence-based philosophies, our objective is for clients to never outlive their money.

The outcome for you is that you can feel confident, retain financial independence, choice of lifestyle and personal dignity.

Ready To Secure Your Retirement?

Book in a time to start your retirement plan today.

Book a Complimentary Meeting-

Our Why?

Our passion is the science of retirement

-

Retirement Success

Relies upon more than just a financial calculator

-

Have Purpose

Know what you're retiring 'to', not just 'from'

-

Time & Money

We align money with your retirement lifestyle

Our Team

-

David Reed

Retirement Adviser

David Reed

Retirement Adviser

-

Sarah Broady

Retirement Adviser

Sarah Broady

Retirement Adviser

-

Peter Taniane

Retirement Adviser

Peter Taniane

Retirement Adviser

-

Mark Hardick

Retirement Adviser

Mark Hardick

Retirement Adviser